Winning the Powerball in Minnesota sounds like a dream — and it is. But once the celebration ends, a crucial question arises: “How much do I actually keep from my winnings?” Understanding what happens to your Powerball winnings after taxes in Minnesota is essential for protecting your prize and planning your future.

Understanding Federal and State Tax Withholdings on Powerball Winnings

Let’s say you hit the Powerball jackpot — congratulations! But before you make any big purchases, it’s important to understand what happens to Powerball winnings after taxes in Minnesota.

Here’s the breakdown:

-

Federal Taxes: The IRS automatically withholds 24% from any prize over $5,000. However, your final tax bill could be up to 37%, depending on your total annual income.

-

Minnesota State Taxes: The Minnesota Department of Revenue withholds an additional 7.25% from lottery winnings over $5,000.

Example:

-

Jackpot: $100 million

-

Federal withholding (24%): $24 million

-

Minnesota withholding (7.25%): $7.25 million

-

Remaining (before final taxes): $68.75 million

Comparing Lump Sum and Annuity Options for Minnesota Winners

When you win Powerball, you’ll choose between two payout options: lump sum or annuity. Each has different tax implications in Minnesota.

Lump Sum:

-

You receive a reduced, one-time cash amount.

-

This amount is taxed all at once.

-

Offers immediate access to most of your prize, but places you in the highest tax bracket right away.

Annuity:

-

Paid in 30 annual installments over 29 years.

-

Taxes are spread out over time.

-

Offers a more stable, long-term income — but with less immediate cash.

So, when evaluating Powerball after taxes in Minnesota, consider your financial discipline and long-term goals. A financial advisor can help weigh the pros and cons of both options.

Calculating Your Net Payout: A Step-by-Step Guide

Here’s how to estimate your Minnesota Powerball after-tax payout:

-

Start with the advertised jackpot (e.g., $100 million).

-

Convert to lump sum: Usually ~60% of the total (e.g., $60 million).

-

Subtract 24% federal withholding: $60M – $14.4M = $45.6M.

-

Subtract 7.25% state withholding: $60M – $4.35M = $41.25M.

-

Estimate additional taxes owed: You may still owe more depending on your final tax bracket.

So your $100 million jackpot might actually leave you with $37M–$41M, depending on how you choose to receive it.

Strategies for Managing Your Post-Tax Lottery Winnings

Once the taxes are settled, smart management is key. Here are a few steps every Powerball winner in Minnesota should take:

-

Hire professionals: Work with a tax advisor, financial planner, and attorney.

-

Create a financial plan: Budget for the long term, considering inflation and market shifts.

-

Invest conservatively: Protect your wealth with diversified, low-risk investments.

-

Avoid lifestyle inflation: Don’t let spending spiral just because your balance is high.

-

Give with intention: Charitable giving can reduce taxable income and support causes you care about.

Managing Powerball winnings after taxes in Minnesota is more than just holding onto your cash — it’s about building a secure future.

Common Mistakes to Avoid After Winning the Lottery

Even large sums can disappear fast if you’re not careful. Here are mistakes to avoid:

-

Overspending early: Many winners go broke within five years for this reason.

-

Skipping professional advice: Tax laws are complex, and bad moves can cost you a lot.

-

Forgetting future taxes: Even with withholdings, you’ll likely owe more later.

Avoid these pitfalls, and you’ll be well on your way to making the most of Powerball after taxes in Minnesota.

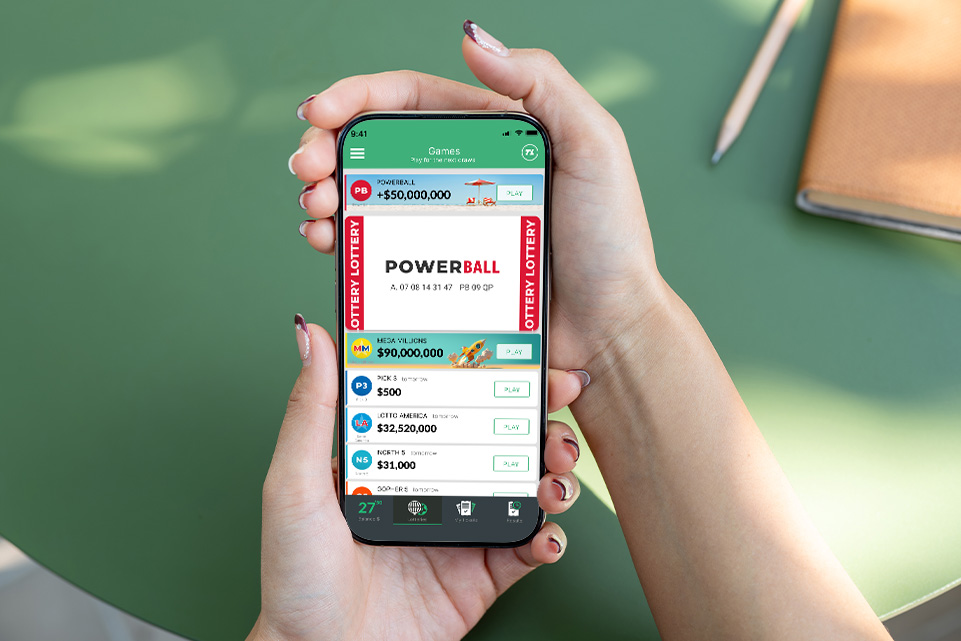

Chase That Jackpot with TuLotero

With TuLotero, you can play Powerball securely, manage your tickets, and even get notified instantly if you win. More importantly, it gives you a safe, organized way to start your winning journey — without losing your ticket or your privacy.

Benefits of using TuLotero:

-

Buy official Minnesota Powerball tickets from your phone

-

Store them digitally — no paper tickets to misplace

-

Automatically receive results and notifications

If you’re serious about winning smart, TuLotero is the tool you need before and after your win.

Dream big. Win smart. And when that jackpot hits, know exactly what to expect with Powerball after taxes in Minnesota — powered by TuLotero.